MARKET NEWS

MarketAxess launches FI opening and closing auctions

MarketAxess is launching opening and closing auctions for US credit “in the coming weeks”.

Opening and closing auctions have long been available in equity and...

Chainlink collaborates with Tradeweb, UBS

Chainlink is capitalising on the industry’s growing demand for tokenisation and on-chain operations, announcing a data partnership with Tradeweb and completing the first live...

Clearstream offers tokenised issuance in D7 expansion

Deutsche Borse’s Clearstream has launched a tokenised securities platform, designed to handle issuance and management.

D7 DLT facilitates the issuance of central securities depository regulation...

Singhal swaps SMBC for Mizuho

Shrey Singhal has joined Mizuho as director of USD investment grade credit trading.

Based in New York, Singhal specialises in insurance and asset managers and...

Ex-Etrading Software exec joins Propellant

Etrading Software’s former chief strategy officer has resurfaced at Propellant Digital, joining the firm as a senior advisor for business development and strategy,

Elizabeth Brooks...

Ares acquires BlueCove, launches systematic credit strategy

Ares Management Corporation is acquiring the outstanding share capital of UK systematic fixed income manager BlueCove Limited, after holding a minority stake in the...

FEATURES

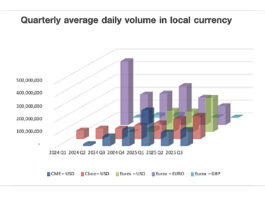

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

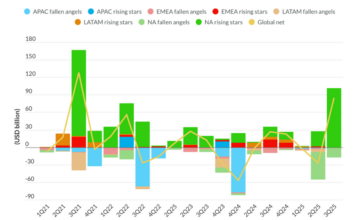

EM debt funds on a winning streak for inflows

According to Morgan Stanley analysis, emerging market (EM) debt funds have seen eight weeks of inflows over the summer period, representing the longest streak...

Fenics Market Data appoints Jonathan Syrén as head of new product development

Fenics Market Data has named Jonathan Syrén as head of new product development, based in London.

Syrén moves from Parameta Solutions, which he joined in...

JP Morgan leads DCM amidst primary markets retreat in Q1 2025

In the first quarter of 2025, global debt capital markets (DCM) activity retreated while JP Morgan maintained its position at the top of the...

Lead : BENCHmark Survey 2018

The DESK BENCHmark: Volumes down, efficiency up.

Fewer traders are managing greater volumes of trading in rates, while the volume of electronic trading is increasing...

Subscriber

Nomura poaches Moritz Westhoff

Moritz Westhoff joins Nomura as head of US rates trading, based in New York and reporting to global co-heads of rates Nat Tyce and...

Asia close: Trading desks report tariff impact muted, US open tense

Following Asia market close, trading desks are reporting that the greatest impact from the US tariffs is expected to be seen upon market open...

Connectivity platforms report FI deals ahead of MiFID II

By Sobia Hamid.

The growth of electronic trading in fixed income is driving connectivity between trading platforms. In 2016, Greenwich Associates estimated electronic trading of...

“A fixed income price is not a fact. A fixed income price is an...

David LaRusso is the head of fixed income trading at Dimensional Fund Advisors, and has just celebrated his 25th anniversary at the firm. The...

GreySpark: FI markets will continue to see fragmentation based on all-to-all trading

A report by consultancy GreySpark has found that in 2020, global fixed income e-trading landscape has been defined by fragmentation in line with historical...

OpenDoor reveals greatest challenge and a turbo-charged match rate

OpenDoor has revealed a significantly high match rate for asset managers on the all-to-all continuous order book it launched in January 2020, to replace...

AxeTrading founders step back from management

AxeTrading has announced that the founders of the firm, together with other members of the Board, have agreed that in order to address “the...

Origination: Brookings Institute: Threat from US debt levels very limited

A new paper by the Brookings Institute has highlighted reasons for concern around the growing US debt pile, and the dynamics that could affect...